Lithium Today is Iron Ore Twenty Years Ago

History doesn’t repeat itself, but it often rhymes – Mark Twain

On the subject of Iron ore, Friedland commented, “Iron, I’m sorry to say it, but WE’RE FLOATING ON AN IRON BALL, THE EARTH. Iron is either the first or second most common element on the periodic table and everyone and his brother are building iron mines. But copper is rare and hard to find and without it we don’t have a modern world.”

https://www.mining.com/web/billionaire-miner-robert-friedland-sounds-off/

That was Robert Friedland in 2013 talking down iron ore…in September 2019 he acquired the Nimba Iron Ore project in Guinea from BHP and Newmont. It’s a very high grade iron ore deposit with low impurities.

What happened to that iron ball? Well, grab some eucalyptus tea and let’s talk about it because the same thing is happening in lithium even down to the denial of investors who can’t believe this is happening. This is something the koala has been thinking about for a couple months and would like to put out there for discussion.

Ideally the right time to have written this out logically was 6 years ago or even 3 years ago, but not everyone can be clairvoyant at the beginning of a super cycle.

So let’s go back to the beginning of the millennium and the year 2000.

Global crude steel production in the year:

· 2000: ~850MM tonnes

· 2011: ~1,540MM tonnes (5.5% CAGR)

· 2021: ~1,900MM tonnes (~4% CAGR from 2000, ~2% CAGR from 2011)

During those same years, let’s consider what the price of 62% CFR iron ore fines was approximately:

· 2000: ~$20/t

· 2011: >$150/t

· 2021: ~$160/t

First, let’s at least acknowledge the journey between 2011 & 2021 was VERY surreal, but more relevantly what happened to iron ore supply in that time period. Let’s focus on the “Big 4” – Rio Tinto (Pilbara), BHP, Fortescue, and Vale that to this day constitute ~70-75% of the seaborne iron ore trade by volume.

There is a lot happening in this chart beyond a near tripling in volume during the 2000s. You have the emergence of the fourth member of the Big 4 out of nothing, Fortescue. Turns out 56-58% iron is worth something when you are desperately short iron units. However as we now see in current times with a focus on high grade metallics, high grade iron units, pellets, and even Twiggy’s focus on hydrogen, in an emissions sensitive world, 58% iron was considered dirt for a reason twenty years ago.

But take a step back and appreciate that while this happened, China went from importing ~70MM tonnes of iron ore every year to ~1.2 BILLION tonnes. If you’ve ever wondered in recent years why it seems China has long term thinking about resources, they probably remember building a global steel industry without having feedstock secured – they want Simandou built and own 15% of Rio Tinto for very obvious reasons.

Now let’s take a look at what lithium demand growth could look like as this electrification/de-carbonization super trend progresses and borrow a slide from Albemarle’s May 2022 corporate presentation:

You know, the koala hasn’t a seen a hockey stick demand growth like that since the global steel market almost doubled in 10 years and actually did over 20 years with the rise of China.

So let’s dive into the plans of the major lithium companies to satisfy this demand.

First up we have Livent, with some rather bold plans per the latest corporate presentation, looks like capacity will be multiples of what it currently is by the end of the decade if they successfully execute their strategy.

Now let’s look at Albemarle who is looking to ~2.5x things by 2025 and then 2x from that level over time.

Given both ALB and LTHM publicly disclosed targets, it will be super interesting to see what SQM says at their investor day in September 2022.

But if you look at all these figures, you see a lot of “steel mills” and not a lot of iron ore. Where is the feedstock going to come from for all this new lithium refining capacity?

Well the major sources of virgin lithium units in the world today are the lithium triangle (Atacama of Chile, Bolivia, Argentina) and hard rock spodumene pegmatites in Australia.

So let’s talk about those in two parts, first starting with the salars of the triangle.

First let’s start with Chile, which currently has only two producers, Albemarle and SQM. Assuming most of you reading this with some eucalyptus tea are versed in mining issues, imagine the emergence of a new Chilean president has crossed your desk at some point this year so far.

Well let’s see how that auction of more lithium concessions went earlier this year…

Chaser (only two days later): https://www.france24.com/en/live-news/20220114-chile-court-freezes-multi-million-dollar-lithium-deal

Layer on all the recent issues with copper and gold mines getting permits (either for new mines or existing mines), is anyone feeling stoked right now to go big into Chile? Didn’t think so.

I won’t dwell too much on Bolivia other than to say the koala will believe it when it sees it.

And as for Argentina, well, let’s see how it goes with the projects going on there. But salars take time to build and commission, simple as that. I think there is something to be said that everyone I speak to around Argentina right now asks themselves “when is the Josemaria fiscal stability going to be announced?” Yes that is for a copper project but everyone is looking for it as a mark of progress for more mining investment in Argentina and it has not happened yet in 2022.

You have to go where the quality projects are and in salars it is those three countries.

As for spodumene hard rock, Greenbushes is the gold standard. And there are a lot of spodumene bearing pegmatites in the world. However, recall the opening to this piece where the simple thinking on iron ore was to simply think Earth was just a gigantic ball of iron, it was not rare?

But you know what is rare in iron ore – the right combination of grade, impurities, scale and logistical ability to bring to market.

And the iron ore market for all the talk of 58%, 62%, 65% index prices etc. has actual brands for its major products.

Rio Tinto has the Pilbara blend (both fines & lump) and Robe River

BHP has the Newman product

Fortescue has the FMG blend, West Pilbara Fines, and the Super Special Fines

Vale has the IOCJ, BRBF and a few others

And these brands have very precise specs because if you are running a steel mill you want to optimize your feed for the furnace.

Same thing in oil, recall earlier this year when Russian oil was embargoed so refineries that were used to using it no longer could, well the koala is not an oil / product expert but if you mess with the calibrations of several major refineries around the world overnight, you probably are not going to get the volumes of product originally planned.

There are plenty of small hematite or magnetite deposits around the world but they don’t get mined for very simple reasons when you consider the importance of grade, scale and logistics. Would you rather pay a little more for a cargo of Pilbara blend or take your chance on a 62% Fe spec fines from a random small mine you’ve never put in your furnace before?

And so with that in mind, a chart IGO published on their Greenbushes site visit earlier this month:

Take a look at what is actually producing.

· Mt Cattlin is a swing asset that is making money today but it’s been put on care and maintenance countless times (though given its a supercycle, so what?)

· Mibra does 90ktpa spodumene (that’s ~12kt lithium hydroxide for context) with committed offtakes but talking of going downstream itself to hydroxide, but that is tiny

· Bald Hill has similar limited production levels – it’s resource constrained

· But outside of those exceptions, what is the name of the game?

You are looking at projects with as a simple test, at least 100MM tonnes of 1+% Li2O grade. That’s the name of the game.

Those are the types of assets that move the needle. And if the electrification / decarbonization trend is going to happen on the timetable aspired to, then we need the new Tier 1 “iron ore” mines of the 2020s just like China needed Rio Tinto, BHP, Vale to expand and Fortescue to emerge in the 2010s.

So simple question – where is the feed for all these massive new lithium hydroxide capabilities going to come from? Now to make it even more interesting, what if western world lithium ion batteries need to contain western content like talked about for EV credits in the recent Inflation Reduction Act in the United States?

This will not be a linear experience. Wodgina is ramping up next couple years, there are other supply sources coming. Very likely at some point we will see supply growth get ahead of demand growth temporarily.

But what I think we are going to see is the emergence of branded spodumene concentrates as the OEMs don’t want to go upstream, the chemical companies want to protect their special chemical valuation multiples by only going upstream as much as required (how much “exploration” will we see from a chemical company?), and the miners realize it is ludicrous to try to go downstream themselves. As discussed in “The Big Fella” there is a reason BHP does not do steel in Australia anymore but does do iron ore – some groups/geographies have a comparative advantage in doing different things then other groups.

This is very important though because anyone who wants to have a hydroxide facility will want to know what their feedstock spec will be for the next 20-30 years they will be running the facility. You’ll want your “Pilbara blend” and not just a random mix of whatever spodumence concentrates are available every month or quarter.

To be clear, this does not mean the lithium prices we see today are sustainable, that is not the koala’s call, but it seems crazy to say long term lithium prices are not materially higher then brokers are using today since we have to incentivize so much incremental supply and the quality projects don’t seem to be there in the pipeline.

I expect some will pushback on this thought piece not considering the rise of a new technology like direct lithium extraction, and to that I will say I want to see it achieved at scale in a few mining operations before I take it seriously. And I’d like to understand if it is an off the shelf solution or if it must be tailored to each orebody – because that seriously effects the pace it can be adopted to address this megatrend of demand growth acceleration.

Until DLE is proven, as it stands today in the west, we have two proven flowsheets to produce lithium carbonate and hydroxide, brine salars and spodumene concentrate from hardrock pegmatites.

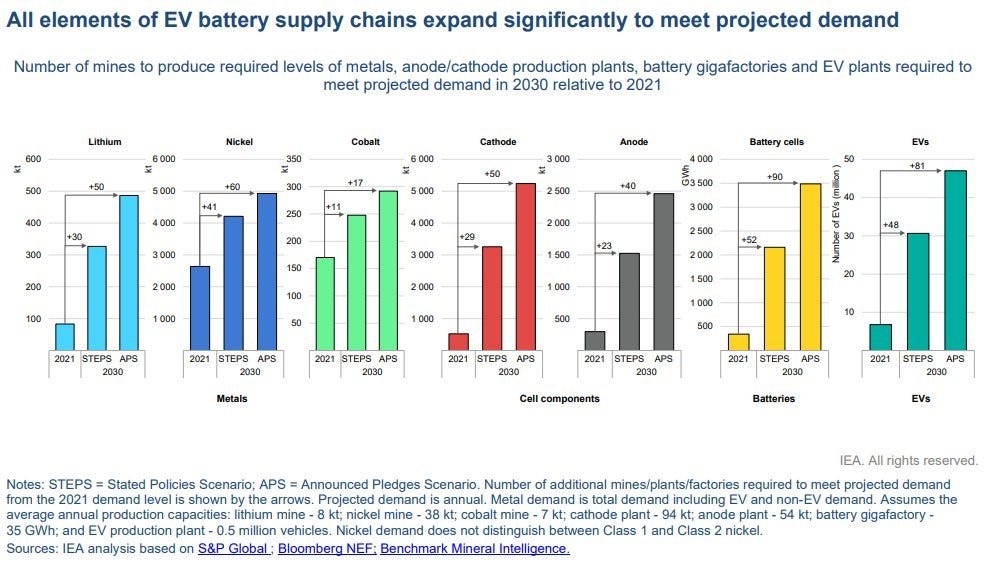

But bottom line, when I took a step back to think about this over the last few months, as we think about what is happening in battery metals, and we see all these fancy charts get shared from the IEA and other sources like S&P Global, Bloomberg, and Benchmark showing how many new mines we are going to need, the koala had this metaphor epiphany.

The simple mental framework for this is the rise of China in the 2000s building steel mills not quite sure where the iron units are going to come from for all of it. We have seen this movie before, it’s just a different lead actor on the periodic table.

So where is the S11D, Solomon, Christmas Creek, Bloom Lake, Roy Hill, Minas Rio, or even just the South Flank or Hope Downs? Because we’re going to need it.

What is the koala missing here sitting in the eucalyptus tree?

I like the analogy to iron ore you make here and it will be useful when analyzing the space moving forward.

However, I always tend to struggle with the demand side of the this. If we use your analogy, Chinese urbanization and infrastructure trends were the point source of demand for all of that iron ore.

Where did the capital for that boom come from? - honest question, please answer... I think it came from an enormous credit bubble- supplied, managed, and expedited by the Chinese government, Princes of the Yen style.

For this "EV boom," the capital is apparently coming from the auto consumer? I just don't see the same type of fast and furious frenzy of consumption and availability of capital for this boom to look anything like we saw in 2002-2009 China. I can't get over the feeling those hockey sticks are just flat out wrong.

The product isn't an iPhone-like upgrade over the incumbent. This isn't going from sails to steam. No matter how much governments and the Davos crowd want us to want EV's, a lot of use don't really give af. And EV's are expensive af. Unless central banks are about to fuel another credit bubble of epic proportions IN ORDER FOR everyone to buy these things.. those hockey sticks cannot be good forecasts of the future.

Reading this in Jan ‘24 after the lithium bust is very interesting. Thanks for writing this!