The Hidden Unvalued Major Miners' Optionality, But Where is the Courage?

Which major CEO will have the courage of Paul Flynn?

The Koala has question for those of you lounging in the shade of the eucalyptus tree.

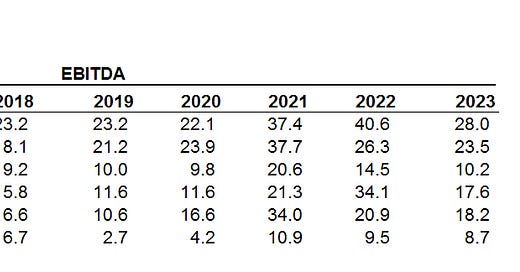

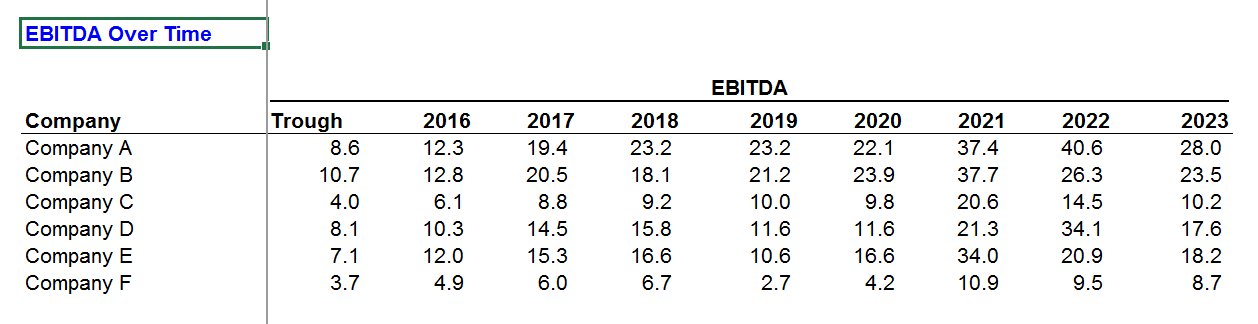

What is the right leverage to put on a set of businesses that has this sort of earnings profile (and yes, the Koala knows, EBITDA is not earnings)?

Dare the Koala have the arrogance to answer its own question but the marsupial thinks the right answer with that sort of time series of data is “Net Debt somewhere between 2 and 3x trough EBITDA”. Because looking at it, with the exception of Company F (and that’s a separate topic entirely), the trough EBITDA for all these companies looks like a total nightmare compared to what a typical year has looked like for close to the past decade.

Let’s first address up front the cyclical nature of some industries. Not only is profitability cyclical, but so too is investor/capital psychology towards them. Coming off the trough when certain attitudes are consensus:

· Iron ore will never average more than $50-60/t ever again

· China steel demand has peaked forever

· All copper growth last 20 years is because of China, if China over copper over

· Thermal and Met coal are going the way of the horse and bubby by 2030

There is a different priority for capital than there is at the peak of cycles. If you consider 2016-2019 in the metals & mining industry, the priority was free cash flow yield to deleverage balance sheets and the return of capital to shareholders. In effect, the cost of investor capital was companies must harvest and decapitalize through shareholder returns. And when you are trading at a double digit free cash flow yield at what at the time were materially lower than today consensus long term commodity prices, the market is telling you not to grow. Or as Ivan Glasenberg said at Bank of America Metals & Mining conference in 2016 “stop building new capacity!”

We have slowly been coming out of that phase to now it’s not about free cash flow and shareholder returns but slowly we are progressing to what the Koala calls the “NPAT & ROIC” phase of the cycle. Are you generating adequate returns on capital and generating good earnings? In short, the industry has earned back its license to invest capital and not decapitalize. Part of that is good stewardship and earnings the last several years on the whole but also an awakened awareness that “oh, metal demand still go up as global economy size go up?”

And while we are far away today (or so it seems from this branch of the eucalyptus tree) with the potential exception of pure play copper producers, the next stage of the cycle will be a focus on NAV growth/accretion as the consensus becomes “there are only 5-10 groups that can deliver what the world is clamoring for at these commodity prices”. That will be a fun time when it comes.

In this current paradigm the markets focus on present and one/two year forward earnings, what has been ignored is how conservatively financed these companies have kept their balance sheets over the last 8 years after the trauma of 2014-2016.

The Koala would proffer to you all as investors, financiers and industry participants/observers that in the context of the trough metrics of this industry, these balance sheet policies are far too conservative. At least Glencore frames it as $10 billion but for the right M&A $16 billion. M&A after all does add EBITDA even at the trough unless you do something extremely stupid.

Under the Koala’s proposed 2-3x trough EBITDA, there is material optionality of over $5 billion and in the case of Rio and BHP $10-25 billion of latent balance sheet capacity in the major public western mining companies.

Or framed another way, the Koala’s 2-3x trough EBITDA equates to 1-1.5x “average historical EBITDA”.

Now very important to this thesis is a thoughtful Treasury strategy that maintains an even maturity schedule, re-finances maturities ahead of schedule, etc. but that is not a hard thing to do. But if say Rio Tinto bought Albemarle (for example) and did it with cash, pretty sure the fixed income markets would be very open to 10 year, 20 year, and 30 year Rio Tinto paper.

And for good measure let’s look at the maturity schedule of say, Glencore at YE22:

Just eyeballing that, doesn’t look to the Koala like the boys and girls in Zug have more than $3 billion of bonds maturing in any given calendar year anytime soon. That’s the sort of maturity liability management the Koala is talking about.

This is not differential equations or multivariable calculus the Koala is suggesting, just logical balance sheet management.

In this capital market environment, this optionality is not valued at all because investors just now as a collective consensus getting comfortable with these companies growing again. Part of that is the natural replenishment of the investors with those that weren’t around in the last cycle and a funny thing about human memory is horrors you witnessed yourself are magnitudes more impactful on you than the horrors you just learn about in history books. But these companies are still populated at the highest levels by individuals who remember those disastrous deals of the last cycle because they lived through it.

As said on a couple podcasts, the first thing a new CEO from an unplanned succession asks themselves is “why do I have this job? It’s because my predecessor did this. Well first thing’s first, I’m not doing that!”

To the skeptics who say “Koala, EBITDA isn’t free cash flow!” go look at the capex profiles in 2023/24 of these entities as capex inflation has started to bite. Rio Tinto aspires to $10 billion, BHP is ~$10 billion, Glencore is $6 billion but who we kidding it’s going to $7 billion.

The point is, in mid cycle, capex is irrelevant to the capacity to service/maintain a responsible maturity ladder. In a down cycle the key is to not have too much committed capex on the come in the next 6-12 months versus trough EBITDA, which, ironically if you consider the annual capex guides today versus trough EBITDA, the Koala reckons there is with some foresight and vision some flexibility to be had which any of these majors pay people to be prepared for. Trough EBITDA less Current Capex is still positive for all these names before we consider how capex naturally comes down in a cycle trough (go look at 2016 capex figures).

This optionality should be valued in these companies and my view is once we see the first one go ahead and do it, this will be the new talking point. And the first one really is Glencore-EVR in the next year or two before Glencore splits into two companies.

So here is the logical follow on question if you agree with this thesis around optionality hidden by these ridiculously conservative balance sheet policies: well Koala, what should the majors be acquiring? Is it just buyback stock which is not EBITDA accretive/credit positive?

The simple reality is there are not a lot of independent producing assets out there that are “major worthy” but aren’t already in the majors portfolios.

The Koala cannot in good conscience say Rio Tinto, BHP, or Freeport valuations justify buying back stock. Anglo, Vale and Glencore is different conversation. But for those three if there is no meaningful M&A opportunities, why not buyback stock up to 2x trough EBITDA (and if Anglo wants to include the outstanding Woodsmith capex in their net debt calculation to be conservative, the Koala would have no pushback)?

But there are some of those assets out there, and the one who goes first will be the one who is most rewarded. After all, whether you pay the 1x $4/lb copper NAV or 1x $4.50/lb copper NAV isn’t really going to matter in 5-10 years at your retirement/farewell party. What’s going to matter is:

Did your operating teams execute on the plan built during diligence?

Did you finance the growth initiative responsibly without risking the balance sheet or the need to raise equity or sell a crown jewel asset in distress?

Directionally where you right that copper was more like $5/lb than $3.50/lb for the next 5-10 years?

You cannot run a major mining company and create real value for all stakeholders including shareholders from a position of fear. Fear of the past, fear of your shareholders (fast money or slow money), or fear of failure. You must be aware and eyes wide open, but you also need to have conviction in your views to not just be like everybody else.

Because growth / premium multiples only come to those management teams, boards, and cultures that consistently deploy capital in a manner that grows earnings and NAV per share through cycles.

Not that this piece is a shot across the bow at BHP to tell them Japan or Saudi Arabia will take their 2030s copper growth plan if they don’t focus on the right end game metrics. Not at all the Koala assures you.

You don’t want to be the CEO that said no to 50% of Pilgangoora because “the ask” was closer to half a billion versus a quarter billion. Having the conviction to pay when the opportunity comes. The Koala isn’t telling you to bet the company, it’s telling you to have the courage to act on the conviction in your vision. If you want to say, build and grow a lithium business to $3 billion EBITDA in the next 10 years it’s not going to happen if you don’t invest capital behind your bullish commodity thesis.

Don’t be a bureaucrat, be a visionary. Be Agnelli, be Chen Jinghe, be the one that actually does something.

You all trade at 8-10x spot P/E (with the exception of one of you – sorry Vale, your depressed multiple is a topic for another day) or 5-6x spot EBITDA. There was a time to do nothing and be conservative. There was a time to buyback your own stock (the JS Jacques era). But don’t tell the Koala you want to maintain optionality and keep dry powder. We all know boards are paralyzed at cycle bottoms.

This, this moment right here where we are in the middle of the cycle, just a question of which side of halftime, is the sweet spot to do something.

If you wanted Anglo’s 44% stake in Collahuasi you had to go hostile on them during the trough of the last cycle in late 2015 / early 2016. There wasn’t a friendly deal to do unless you were willing to pay a massive premium. But Sumitomo had the clarity of thought to buy another 13% of Morenci for $1 billion. The metrics looked crazy at the time but they knew that was a once in a generation moment to get a piece of an asset like that.

This is all lovely prose but what do we have to show for it in big ticket M&A from the major western mining houses when the biggest M&A deal from memory is the pending Glencore-EVR transaction? That’s right, for all the battery metals and future facing commodity talk, the biggest deal is a coking coal deal. Nippon for US Steel does not count because what the Koala is saying here the Japanese trading houses and metals & mining industry already agree with if you look at their deals. This is directed at the western mining houses.

But that deal does show us that when the race starts on assets/portfolios we all agree are strategic the premiums can take on a mind of their own.

The first is a hero, the last is the one who has explaining to do.

“We are buying ABC, it’s a world class / Tier 1 asset that belongs in our portfolio. We are paying a 50-100% premium and paying all cash. Our balance sheet will be levered 2-3x Net Debt / trough EBITDA after the transactions closes and we believe this will be Y% accretive to earnings at this commodity price deck”

Who is going to be the first major CEO to have that quote in a press release announcing a copper, lithium, nickel or iron ore deal?

And while this basically a treatise telling the majors to stop talking and start buying in their preferred commodity of choice when there are so few assets that would be a fit, what the Koala has ironically said in ~2000 words is:

See Paul Flynn? See what Whitehaven did levering up to buy Blackwater and Daunia? See how positively the market received that deal when it was finally announced? Maybe take the cue the market and investors are giving if even a coal company has license to deploy capital at compelling returns instead of just returning all free cash flow to shareholders through dividends and buybacks?

As cycles are before, so they shall be in the future.

Why isn't the comparison to buying back their own shares to create PER SHARE increases in value?

Agree that they should pursue world-class assets and use balance sheet responsibly...but assuming you are tier 1 and have world class assets already (not all, but at least some right?), then isn't the shareholders only focus on how much of the production/reserves/EBITDA I'm getting per share? And buying shares gets me to the same place as a shareholder, with a lot less risk?

And especially on a risk-adjusted basis, if can buy own shares at 5x EBITDA or buy another asset at 5x, buying more of own shares seems like no brainer? No deal/geological/integration risk. Just push a button and create value.

Basically, if company buys back 50% of shares (helped by responsibly using balance sheet capacity) over a few years, and per share production/reserves 2x, isn't that just as good as buying another asset to 2x production?

Obviously rare chances to own unique/HQ assets, but bar should be VERY high..

Which management would you bet on (to move first) GLENCORE?