The Eucalyptus Tree Goes to the Moon: The Koala’s Visit to Goma & the Bisie Tin Mine

I always say when asked about my views on jurisdictional risk “I won’t invest my capital somewhere I wouldn’t go myself”. And over the past four years as an investor in Alphamin Resources “AlphaMoon” as the balance sheet deleveraged, tin had a $50,000/t moment, a sales process was initiated then cancelled, and a second mine was built right next to the first one, the company truly became the poster child for this test. It’s a name that has divided everyone the Koala discusses mining with.

No one questions the asset quality but everyone is petrified of North Kivu, DRC. And if you read the press it sure does sound frightening. Goma, the provincial capital of North Kivu, has been temporarily taken over by rebels as recently at 2012, sits at the base of a volcano that erupts with some regularity, and unfortunately has had its fair share of disease outbreaks over the years.

The cherry on top is the stunningly beautiful Lake Kivu has massive reservoir of natural gas sitting hundreds of meters below the surface of the lake but actually in the lake. Which means if the lake ever turns over such that the gas layer can reach the atmosphere it will likely asphyxiate a lot of the people that live near its shores.

Scared yet?

Sprinkle in the semi-frequent headlines about rebel activity by either M23 or FDLR outside Goma particularly near the Rwanda – DRC border, you have all the ingredients for the perfect recipe to create a “jurisdiction risk” poster child.

And to make it even more perfect, AlphaMoon has continued to generate profits at basically any tin price we’ve seen since Mpama North was commissioned pre-pandemic.

So this perception forever has cast a Sword of Damocles shadow over the valuation and how the market perceives the company and it’s value.

I don’t want to dwell too much on valuation / price targets, I’ve thrown some out there before and will just offer up this snapshot, name your tin price and your tin sales volume, and that’s my best guess what the dividend yield will be on the current ~C$1.25/sh.

I’m also not going to focus on a million incremental details, every mine and flowsheet has potential optimizations to do, the question as always is payback.

What I want to focus on in this postcard from the Moon are three things:

1) Goma – reality v perception

2) ESG – the positive impact of mining on communities

3) Exploration potential

First, Goma…

I’ve been lucky enough to visit a couple other East African countries on holiday and quite candidly, Goma is very similar to some of those cities. It’s quite clearly poorer, when taking off and landing you cannot help but notice that Gisenyi right across the border is more developed and appears wealthier, but at the same time you see bustling markets.

We had to spend a night in Goma before going up to site, and next to our hotel (which was simply lovely) there was a 8-10 story building under construction as either apartments or a brand new hotel.

Yes if you try to drive out of Goma into the country side, especially north near the Rwandan border, you are going to end up on roads that are controlled/contested by rebel groups and criminals. There is still a robust smuggling industry along this border in northeast DRC. But we need to acknowledge just how big (and lushly forested) North Kivu is. There is a very clear and obvious economic incentive to smuggle extremely value dense minerals like gold or coltan and not pay taxes or royalties.

Given that in the past a lot of traders from China would buy this artisanal material (which frankly does fund some of these rebel and criminal groups), it should not surprise you I saw basically no Chinese people around Goma. But I did see several other foreign cohorts present.

This region has its history and scars, but the vibes of Goma are not that of a city whose population are prepared to collapse tents and flee on a moment’s notice because “the rebels are about to take the city”. What I saw was a city of ~1-2 million people who are focused on, to borrow a phrase from venture capitalists, “building”.

Yes there were some shoddy shacks and tents as refugees have moved to Goma from the region for both economic opportunity and to escape conflict in some of the more rural areas of the province. It reminded me of the first time I went to Oyu Tolgoi in October 2016 and spent 4 days in Ulanbataar beforehand. Vividly recall all the yurts pitched on the hillsides surrounding the city. Many of those former herders came to the capital city after a brutal winter killed most of their herds and thus their livelihood. In fact if you look at the evolution of Ulanbataar’s population over the past several decades, it has almost doubled in 20 years to ~1.5 million. It represents ~50% of the entire population of Mongolia.

I take the fact regionally displaced population has taken refuge in Goma and how Goma appeared to me as a constructive signal about the city that it’s a place of opportunity.

I’m not going to tell you to go see the gorillas in DRC instead of Rwanda. I’m not going to tell you just to hail a taxi at the airport. I’m not going to tell you that flying into Goma you won’t notice a difference between Gisenyi and Goma (the border cuts right through the “city”). But what I can say having seen it, Goma is like basically every other small city you encounter in emerging and frontier markets. It is not a war zone or Dresden in 1946.

And as for where Bisie is located in the province, it is a relatively stable part. Turns out employment opportunities and economic growth have some positive externalities. Equally, tin is sort of the perfect commodity for this area because its value dense enough that it can absorb the logistical cost of taking it to market. But it is not so value dense that it is attractive to smugglers and their ilk.

The export trucking route is 30-40 km south to the N3 highway at which point it goes north to Kisangani before there are multiple pathways to the border with Uganda. It takes 15-20 days for trucks to make the 1,000+ kilometer journey and at any given time there are 100 trucks somewhere along the route. And since commercial production, AlphaMoon has not lost one truck (where you going to go with 60% tin concentrate?).

But I tell you this because it bears opening up Google Maps and looking where Goma, Bisie, and Kisangani are, along with Beni which is the major city in the DRC closest to the border crossing AlphaMoon uses into Uganda. While the ongoing conflict is tragic, rebel activity north of Goma near the border with Rwanda does not have a direct impact on the export logistics.

And it’s worth noting the road from Kisangani to the border with Uganda is a major economic artery for trade of goods both in and out of Kisangani which is a major town. This isn’t just a road used by a few trucks by a mining company.

As a bit of a non-sequiter, a quick Google search shows that 70% of hedge funds close with 4 years of opening. And of course the longer you have been around the more likely you are to stay around. Bisie has been in commercial production for over 5 years (September 2019) with minimal issues beyond the occasional bridge issue when it rains too much.

There is also an anecdotal stat that the median tenure at a multi-manager hedge fund is less than 2 years.

Why does the koala bring these up? Because for anyone institutional reading this, let’s put the situation of AlphaMoon operating North Kivu in context you’ll appreciate.

For >95% of institutional investment professionals, AlphaMoon will continue to operate successfully in North Kivu longer than you stay in your current seat voluntarily or involuntarily.

Shall we have an honest conversation about “jurisdiction risk”?

ESG…

We can touch on many facts here. Like AlphaMoon being the largest tax payer in North Kivu province. The direct ~1,800 employees mostly from the area around the mine where there is basically no other commercial economy. The healthcare for all dependents and school fees for children of employees.

The fact that along that 1,000 kilometer export corridor villages have cropped up to provide the truck drivers with lodging, food, etc. The indirect economic benefits are felt through the whole province.

But more I want to touch on the several employees I met on site who have been working at Bisie since “the beginning” 12+ years ago. The pride they have in what has been accomplished. From having to trek 40 kilometers through the bush to get to the project, to building a road, an airstrip, to eventually building a mine. I truly cannot comprehend how crazy the original investors and management team must have been to attempt this.

The mine has given so many opportunity in an area where there is so little so the appeal of illicit activity is so obvious.

In an age where we are constantly told the mining industry is evil raping and pillaging the earth, I challenge any ESG investor to do the work on AlphaMoon and tell me why it shouldn’t be in every single ESG and Impact fund. Feel free to reach out if you want to discuss the company.

Wouldn’t it be nice to invest in something having a real tangible impact in one of the least developed areas of the world?

Exploration…

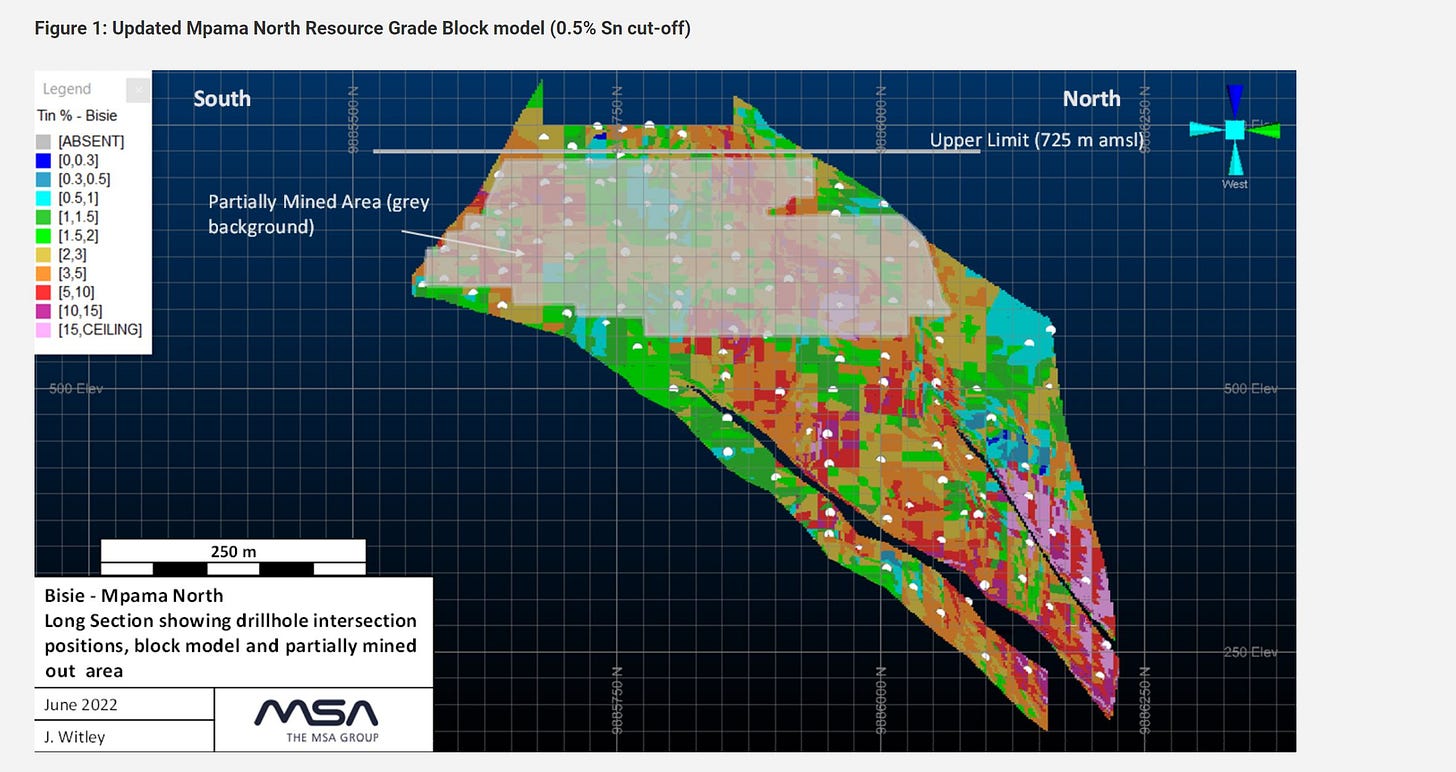

Many people asked me ahead of this trip, is AlphaMoon going to start up exploration drilling again now that Mpama South capex is in the rear view mirror? Fear not, I saw the exploration rig in operation on Level 16 of Mpama North. There is also going to be one at Mpama South but didn’t see that one. The plan is to test the lateral strike length of Mpama North as the current resource has it narrowing at depth albeit the grades are much higher.

In fact, at one of the deepest levels of the current mine plan the last stope on one level has a 10+% tin grade. In comparison to higher up in the deposit where mining has already happened, typically the high grade slowly declines as the edge of the deposit is approached and the last stope on a level is the lowest grade.

This got the Koala curious why it hadn’t put this all together before but it turns out the company flagged this implicitly back in August 2022 when it released the updated resource.

It leads to a fascinating hypothesis to test – it is extremely unlikely that a 12-15% stope is the edge of the ore body at depth. Where is the rest of the mineralization? Well, that’s what the drilling is going to try to find.

Given the visible nature of cassiterite at these grades (and the density – you hold a piece of cassiterite drill core versus waste, a blind person would even know), the company should know without even certified assays if they’ve found something material. Realistically, I would hope to see some news on this front by the BMO conference end of February 2025.

If this hypothesis checks out, that would mean there are more stopes at each level in Mpama North so there is more ore per meter of decline development (20 stopes instead of 15 for example on each level). That improves cost efficiency.

But also, as the grades are getting richer as both Mpama North and South go deeper, the decision by management to design the Mpama South plant to be able to take Mpama North grades, the effective capacity of the mine and flowsheet is 25,000 tonnes contained tin per annum, not the current 20,000 tonnes guided. The limiting factor is the grades.

The company will probably need a couple more trucks as the mines get deeper but same time, the Koala suspects by 2026 or 2027 the sales volume will be closer to 25,000 tonnes per annum than the current 20,000. That’s half an Mpama South at practically zero incremental capital expenditure.

Combine that with an expansion of the reserve and resource, which realistically is not likely to be compiled and confirmed until 2026 if exploration is successful in the next 6-12 months, the Koala walks away thinking Bisie is not a 10 year (current official mine life) 20kt per year tin mine but a 15-20 year operation at 25kt per year, without considering any potential regional exploration success.

Exploration to extend the mine life beyond its current term is one of the most impactful uses of capital for the company today. Hopefully by 4Q24 results in early 2025 we are hearing the exploration budget has expanded from $4 million to $8 million – you don’t grow budgets of exploration programs that are not finding anything.

Let’s focus on one value creation stage step at a time. Now that we have a refreshed dividend, the next value creation opportunity within the company’s control is this exploration program. You got to first go to the Moon before you go to Mars.

Conclusions

North Kivu, DRC is obviously a frontier region and economy. This is not the USA/Canada/Australia. But the asset quality of Bise is undeniable. The positive social and economic impact is real. And while the region has a tortured tragic history, western investors and markets have the wrong perception.

This was the first site visit for shareholders of Alphamin Resources excluding the majority shareholder Denham Capital. I’ve encouraged management to do more of them. I think as more western investors come and see for themselves what this all about versus what they read in the press, the perception will change for the better and more investors will be comfortable owning shares in the company.

And if that doesn’t happen, happy to relax and collect dividends waiting for the tin cycle. A double digit coupon with a 10+ year call option on the tin price is a pretty attractive opportunity.

If the koala had to say where it thinks the stock should be trading if this exploration effort works out, it’s somewhere between C$1.75 – C$2.00 / share. Practically speaking you may see some share supply come in as dividend oriented investors tend to sell when yields optically compress due to share price appreciation, so perhaps it doesn’t get to those levels until 25,000 tonnes per annum is flowing through the P&L in a few years. But you are getting paid to wait.

The eucalyptus model is running 20kt in 2024 and 2025, then stepping up to 22.5kt in 2026 and 25kt in 2027 onward. Dealer’s choice if you want to assume 15 years or 20 years (there is probably more there but again, one step at a time).

But what’s important here is, you don’t need the tin price to go up from here (that would be nice though, and over time I do think cost curve evolution is favorable to the margins at Bisie) to see continued upside in the share price.

To the moon the Koala went and now it has comes back.

Are you actually even surprised?

Very nice write up. Listened to it while driving, gotta love the substack tool for that. Inspiring listen

Appreciate all the boots on the ground coverage and insightful data points.