A note from the Koala: This was originally going to be released in November 2024 after cancelling the attempted SPV around this opportunity. At the request of certain parties, I withheld publication until now as it has sort of hit a “now or never” point on publishing with the new mine plan due for publication in the next few months, potentially even next few weeks.

I have basically kept it 98% as it was going to be published in mid-November so sorry if it refers to gold/copper prices and the share price back then, but I think it merits seeing how I was thinking then and how it still holds up today. I hope you enjoy learning about an opportunity I started working on in 2Q 2024 and was silent about for the past 9 months. It has become a major PA position for the Koala, and it’s a real shame an SPV could not get sorted. But that’s neither here nor there, I give you all – Au Thrilla in Manila

NOVEMBER 2024

So this was going to be the target for the Koala’s first special purpose vehicle (SPV) but the one western broker (Schwab) I identified as able to trade in Manila was not okay with the SPV entity opening an account (I understand, they are a Retail/RIA platform and I’m not an RIA) . And no prime broker is playing ball on a $3-5 million SPV unless it’s part of a broader book of business with an institutional client…so here we are…no performance fee me, but hopefully a nice opportunity for thee…

The koala is not a gold bug. If anything, the koala looks down on gold producers and if you wonder why, look at a chart of GDX since inception versus GLD. The subsector has not created value for shareholders at all. In fact, the koala would go so far as to say most investor’s cumulative returns would be superior if they never heard the word “gold”.

There are exceptions of course…the Koala has only two pure exposures to gold these days, the Kinross/Great Bear CVRs and, OceanaGold Philippines (OGP PM) listed on the Philippine Stock Exchange in Manila.

And yes, even as a retail marsupial not living in Philippines, the Koala was able to buy it personally by just placing a trade with Schwab’s international trading desk over the phone. And for institutional investors, both CLSA and UBS have a presence in Manila.

Been quiet about this one for 6 months, but it’s time to discuss a low cost, high margin gold producers trading at a material discount to NAV, especially compared to the peer multiples.

But first let’s discuss the background to why this listed security even exists and for nostalgia the Koala is going to use it’s verbal pitch for the SPV verbatim.

There is a really high margin gold/copper mine in the Philippines called Didipio owned by a western mining company. They were making a lot of money and employing a lot of people when in 2019 their mining license/permit expired after 25 years. The company went to government and said “we can get an extension right?” and the TLDR of it all is the government smiled and said “oh no, we’re going to have some fun with you”…

Took a couple years of blockades, only processing stockpiles, negotiations, and shenanigans but eventually a 25 year extension until 2044 (so retroactive to 2019) was agreed upon so mining from the underground could resume but with a few new conditions…

1) An “additional government share” (AGS) of the mine’s net revenue was established that basically guarantees the Philippines 60% of “net revenue” from the mine

2) OceanaGold had to list at least 20% ownership in the mine on the Philippine Stock Exchange within the next few years

OGP PM had its initial public offering in May 2024, 20% of the shares are floating and held by the public and 80% of the shares are owned by OceanaGold. This mine may be only 20-25% of Oceana’s gold production but it’s close to half of its free cash flow (especially at lower gold prices) so there is a 90% dividend payout ratio of free cash flow on a quarterly basis.

And that brings us to why we are here today.

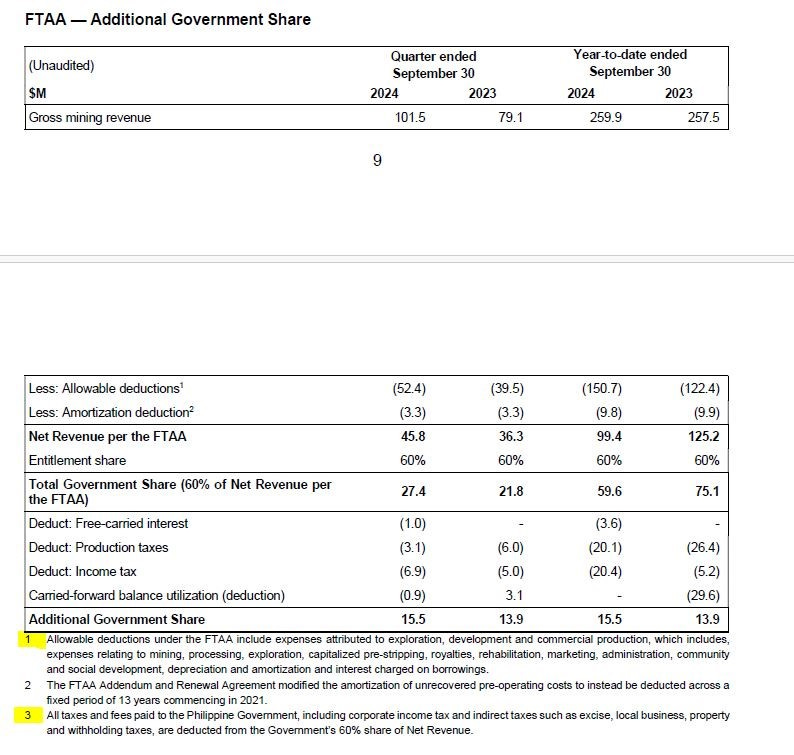

There is one thing up front that merits clarification and it’s in the IPO materials and corporate presentation – the “AGS” is on net mine revenue but basically the way you should think about it is as a superprofits Net Profit Interest sort of royalty. Net mine revenue allows for several deductions (as seen below in the footnotes from the 3Q 2024 10-Q).

The simplified way to think about it is the Philippines get 60% of pre-tax free cash flow with deductions for taxes paid. The AGS accrues throughout the year and is paid annually (hence 90% payout ratio creates essentially a reserve account through the year with the idea that dividends will be more forecastable).

As we get into the mining operation itself what this basically means at current gold prices is that an ASIC of ~$1,000/oz is more like $1,400/oz after incorporating the AGS. But like the Queensland coal royalties, the AGS will compress if gold prices correct.

Now with all that said, the host nation here has extracted its pound of flesh for the license renewal. So we can move on and look forward to wondering what is the Didipio mining operation and why the Koala is so excited.

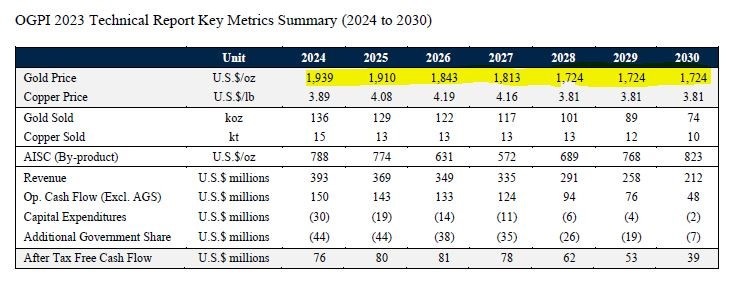

First, let’s look at what this mine is using the prospectus from 1H 2024. It’s basically a very high margin gold/copper mine that does ~120 koz gold per year and 12-14 kt copper per year. Please note the base case price assumptions here versus where the world is today.

And also from the technical report, the full LOM mine plan:

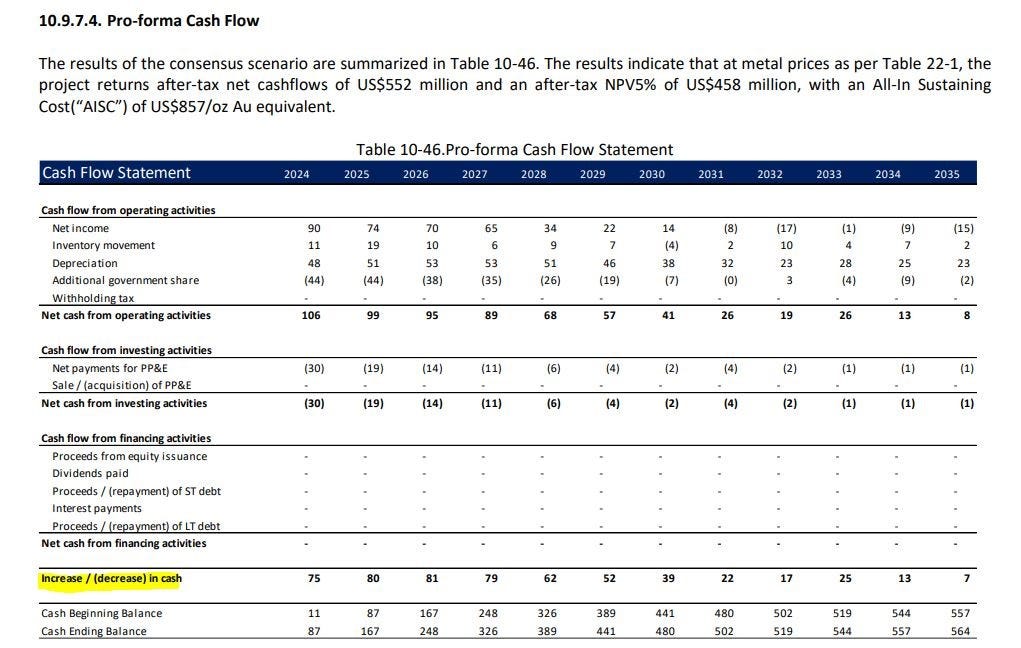

So for good order you can see how the koala put together it’s model for “Project Macarthur” here is the cash flow statement for the full mine plan using base case production and gold/copper prices.

And so you can see basically the koala for 2031-35 backed into an implied ASIC based on the free cash flow. To be candid, not perfect because AGS is coming out too high but irrelevant because:

1) Overwhelming majority of the free cash flow and value is in the 2025-2031 period of the mine plan

2) The updated mine plan in 1H 2025 will push this “tail” out another couple years (the 2022 mine plan based on reserves only ended in 2033 for example)

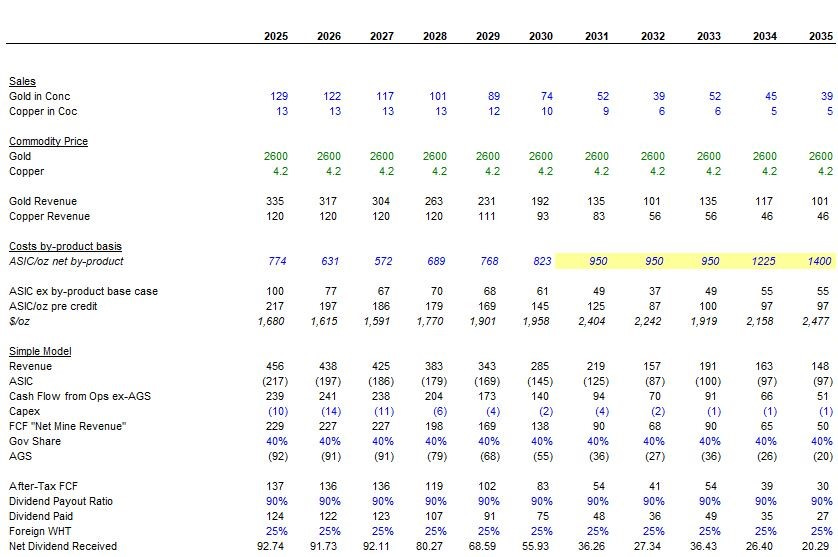

So here is the koala’s model using $2600 gold and $4.20 copper. Would like to flag you will see the koala used 40% to calculate the “government share” because in the base case scenario in every year 2025-2031 the AGS as a percentage of “after-tax free cash flow” is 35% or less. The reason for that is because AGS takes into account things like depreciation which is in excess of capex (so my net mine revenue in the base case prie deck is “too high”)

As the sensitivity of marginal free cash flow is linked to 60%, that all-in number will naturally rise up if we start plugging in $2600 gold prices versus the base case. As a result, my figures at $2,600/oz are probably a little bit too high for 2025/26 but that is not the critical reason you own this stock. So forgive the koala if at $2600 gold or higher it may be setting consensus 5-10% too high, this isn’t exactly a stock or situation for pod monkey’s trading quarters.

So for a company trading at… PHP 15.00/sh with 2.28 billion shares outstanding, the local market cap is 33.42 billion PHP.

USDPHP is 58.91 at the time of this writing

So USD market cap is $567 million

Which means at $2600 gold and $4.20/lb copper, the free cash flow yield is ~24% for the next few years and so the dividend yield is 20+%. Even if you live in the United States and face a 25% withholding tax, it’s still incredible. And remember, you’d have to pay a 20+% tax on the dividend ANYWAY and the foreign tax credit applies (so, this is not an IRA stock).

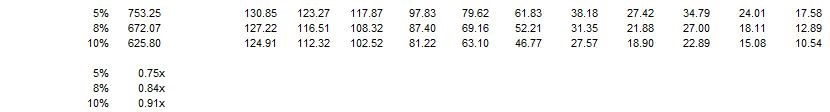

So what we have here is a low cost, high margin mine trading on the current mine plan at 0.75x P/NAV using the 5% discount rate that is traditional for gold producers (we can argue the stupidity of that 5% another time, but for good order, it’s 0.91x P/NAV if we use 10% discount rate instead).

So why is this so exciting? Because even if gold prices go lower you have a nice margin of safety through the valuation because of how robust the margins are. Case in point, in the IPO prospectus the 5% NAV was disclosed under two price decks, the base case ($1724 as show above) of $458 million and at $2,326/oz (spot around the time of the IPO) of $622 million.

Put another way, gold prices can go back to $2300/oz from current $2600/oz and at the current $567 million valuation you basically are still trading at a small discount to 5% after-tax NAV.

So this is all lovely and exciting financial and valuation math but anyone with a finance degree and an 8th grade reading level could have done this analysis and put this together. So why koala is this so special and unique besides maybe only 5 people outside the Philippines know about it and not been too lazy to take action?

Because the real prize in a Cobar like mineral system such as this is that they seem to always have “5 year of life remaining for the past 30 some odd years” to borrow a phrase from another management team. It’s in the reserve/resource replenishment such that you can collect that 24% free cash flow yield in 2025 but effectively the same NAV in 12 months because net depletion was minimal. Think how Duncan described during the Anglo/BHP tussle how a forever mine like Collahuasi is almost an annuity.

Didipio isn’t a 100 year mine where you don’t worry about depletion, but here is where the alpha lies for us. Same way once a junior miner puts out a maiden resource the market tends to stop dreaming of how big the system actually will end up being and focus on Phase 1 development/economics, everyone is anchoring to current mine plan NAV. And the proof in the pudding there is the valuation.

So what is the real NAV and real mine plan here?

The current reserves run to the RL2100 mine level and that 180 m vertical height from 2280 to 2100 is “Panel 2” and is the current mine plan to 2035 involves mining Panel 1 and Panel 2. With that said, material mineralization has been intercepted as far down at RL1700. The way you should think about this mine as ~200 m vertical panels with Panel 2 having some inferred resource and Panel 3 being entirely inferred at this point but intercepts suggest the resource continues at depth and offers the potential for even a Panel 4.

Now a couple notable points, notice the yellow inferred in Panel 2. The mine plan is reserve only. Reserves can only come from measured and indicated resources. If that yellow inferred in Panel 2 is upgraded to M&I through infill drilling underground, boom your production levels for 2031-2035 will go up because instead of mining “waste” you’ll be mining mineralized rock.

Without getting too detailed and projecting false confidence/precision, it seems clear to the koala that Didipio is not a depleted mine in 2035 with a production cliff in 2031.

The new mine plan in 1H 2025 will show improved gold and copper volumes for the early 2030s and an extension of the mine plan beyond 2035.

And while it’s probably beyond any of our time horizons, and there is probably more capital required in time than the $100-130 million flagged in the prospectus for upgrading the underground from 2MM tpa to 2.5MM tpa (the plant takes both low grade stockpile feed and underground ore at a rate of ~4.3MM tpa) in the next few years, the Koala doesn’t think it is crazy to say OGP will be negotiating a second FTAA/license extension in the 2040s.

After all, this is just one underground ore body on the land package. We haven’t discussed the prospectivity such as Narpatan.

But candidly the market is not going to care about that for a long time. This is a low multiple high free cash flow dividend machine that will attract those types of investors and the opportunity is the mine life is a lot longer than everyone thinks and so the multiple is almost certainly going to remain compressed. But that’s okay at these sorts of valuation levels!

It’s not coal equities at 2x FCF back in 2021 but for gold this is the closest you are going to get.

Now we need to acknowledge the risks. This is a single asset company. If there is an operational disaster at Didipio it is not going to be fun to be a shareholder. If there is a natural disaster in the Philippines near the mine, or the Philippines decides not to wait until 2044 to recut the economics (I consider unlikely) those are the big three risks.

Personally the koala is comfortable accepting those risks.

Now one word on the dividend policy. The koala is normally partial to buybacks but sometimes circumstances don’t allow for it. After all investing in natural resources comes down to three basic things:

1) Comfortable view on the price deck

2) Confidence in management’s ability to execute the operating plan

3) Confidence in management to not light money on fire

The last one is a big one especially in gold as management teams in the sector have a habit of deploying capital poorly. See again the GDX v GLD chart mentioned at the beginning, the sector seems incapable of compounding capital to create value.

But hey, here OceanaGold needs this free cash flow hence the dividend policy. This was ~50% of OGC free cash flow in 3Q 2024. How that is when gold prices are where they are and on a $/oz basis this is there most profitable mine I’m not entirely sure but the Koala would rather own OGP at a $567 million market cap than OGC at a ~US$2.1 billion market cap.

As for an informal price target or fair value estimate. The koala thinks the real value here is probably PHP 29.00 which would be a 12.5% free cash flow yield. That is basically the koala’s view that the production levels we see 2025-2030 are likely to continue albeit maybe with slightly higher costs through the 2030s. That would be almost 100% upside from current levels.

Now more practically and commercially, how about we just call it 1x 5% after-tax NAV using $2600 gold an $4.20 copper which would be US$753MM market cap, or ~20 PHP for 34% upside, and enjoy an 18% free cash flow yield going forward as the mine plan is updated every 2-3 years to show the reserve and resource is not rapidly depleting.

UPDATE – FEBRUARY 2025

And from when the koala wrote this in November to publishing it now in February, gold is now closer to $3,000/oz than it is to $2,800/oz.

At $2,900 gold and $4.75/lb copper, at PHP 17.00 share price, the koala estimates a FCF yield of 25% in 2025. That implies a dividend yield in excess of 20%. And we haven’t touched at all on the legislation in Manila awaiting Presidential signature from earlier in 2025 that may reduce dividend withholding tax for foreign investors from 25% to 10%.

The stock today at PHP17 (while we await the 4Q 2024 dividend declaration this week which should come with OceanaGold 4Q 2024 earnings) basically reflects that gold and copper prices are higher, no valuation uplift or recognition in the market for the mine plan upside the koala has flagged here or just the broader re-rating an asset of this quality deserves.

The Koala estimates 5% spot copper and gold price NAV under the CURRENT mine plan is ~$900 million versus a market cap of ~$650 million. And the mine plan is conservative.

Do your current gold producer equities have this sort of EBITDA and free cash flow margin per ounce at this sort of P/NAV valuation with a disciplined capital allocation framework?

The koala asks the same question it (internally) asked in November 2024 at $2600 gold and $4.20 copper, why isn’t this a PHP29-30 / share stock?

Thx for the idea, too bad, that this one is not tradeable on Ibkr.